Avoid the stock market.

Build safe & secure wealth.

Guaranteed growth.

Liquid

assets.

Tax-free withdrawals.

Your future should

never be a gamble.

Take control.

You want a safe and guaranteed wealth-building strategy that doesn’t leave you reliant on a shaky stock market but, when safe = an itty-bitty ROI, you feel out of options.

As a Financial Empowerment Coach and a Licensed Wealth Strategist, I help my clients build safe and secure wealth at a rate of return that’s higher than the stock market, over time. It’s a 200-year-old strategy that the wealthiest people like the Rockefellers, Walt Disney, PJ Morgan, and Ray Kroc of McDonald’s have used to help multiply and retain their wealth.

Do any of these statements describe you?

You are paying down debt and working to build wealth you can access for large purchases, including business and real estate.

If this is you, keep reading about our Wealth Builder Account.

Discovering Financial Harmony:

The Role of Indexed Universal Life Insurance in Your Wealth-Building Journey

The Desire for Integration:

How IUL Fits into Your Financial Landscape

At TetonPines Financial, we’re your guides on a journey to a future filled with security and abundance. We know all too well how managing finances can sometimes feel like navigating a labyrinth—dealing with investments here, insurance there, and debt management looming like a constant shadow. That’s why we’re passionate about shedding light on a little secret that could be a game-changer for you: Index Universal Life Insurance (IUL).

The Puzzle:

Solving the Pain Points of Investments, Insurance, and Debt

Imagine a solution that fits perfectly into your financial puzzle, addressing the challenges of managing various financial products independently. Many of you have voiced your frustration with disjointed financial strategies and the need for a unified approach. You’ve highlighted the struggle of not having a comprehensive plan that aligns your immediate needs with your long-term aspirations. This echoes a sentiment we often hear: the longing for a financial plan that feels complete, without gaps that leave you wondering if you’re truly on the right path.

Bridging the Gap:

From Debt Elimination to Wealth Accumulation

IUL stands out as the sought-after solution that bridges the gap between debt elimination and wealth accumulation. It’s more than just insurance; it’s a strategic ally in your financial journey. Imagine a safety net for your loved ones that also serves as a growing, tax-free nest egg for you. It’s the integration you’ve been craving, where managing debt and building wealth are part of a harmonious strategy, not opposing forces.

One of the key ways IUL aids in debt management is through its policy loan feature. You can borrow against your policy’s cash value, providing you with liquidity to pay off high-interest debts or cover unexpected expenses without derailing your long-term financial goals. This loan is tax-free and can be repaid at your own pace, offering flexibility and control over your financial situation.

But here’s the kicker: even when you take out a policy loan, the account inside your IUL policy continues to accumulate wealth. This means your money is still working for you, growing tax-free despite the loan. It’s a game-changer in financial planning, allowing you to tackle debt while simultaneously building your wealth, all within the same financial vehicle.

The Financial Swiss Army Knife:

Versatility and Simplicity Combined

We’ve listened to your calls for synergy among your financial products. The beauty of IUL lies in its ability to mesh with your financial landscape, bridging the gap between debt elimination and wealth accumulation. It’s like having a financial Swiss Army knife at your disposal—versatile, efficient, and surprisingly simple.

Another aspect that adds to its Swiss Army knife-like functionality is the potential for tax-free income in retirement. The cash value accumulated in your IUL policy can be accessed tax-free through policy loans, providing a source of income that doesn’t increase your tax burden in retirement. This feature can be particularly valuable in managing taxes on other retirement income sources, helping you keep more of your hard-earned money.

Crafting a Strategy That Fits Your Unique Narrative

And speaking of simplicity, we understand the yearning for a financial strategy that cuts through complexity. In a world brimming with intricacies, achieving simplicity without sacrificing sophistication is the ultimate goal. With IUL, we aim to demystify financial planning, offering a solution that’s both accessible and empowering, especially for those with bustling professional lives.

One key advantage of IUL is its ability to streamline your financial strategy by combining the benefits of life insurance with investment growth potential. IUL reduces the need for multiple financial products. This integration simplifies your financial landscape, making it easier to manage and understand. You no longer need to juggle separate insurance policies and investment accounts; IUL brings them together in one cohesive package.

Adapting to Life Changes:

Ensuring Your Financial Strategy Evolves with You

At TetonPines Financial, we recognize that life is a journey full of twists and turns. As your circumstances and goals shift, so should your financial strategy, too. That’s why we are committed to creating plans that are not only tailored to your unique narrative but also flexible enough to grow and change with you.

One key way we empower the dynamic approach is through maximizing funding for your IUL policy. This strategy supercharges your path to financial freedom, providing a robust foundation that adapts to your evolving needs. Whether navigating career changes, family expansions, or shifting retirement goals, max funding your IUL ensures that your financial plan remains relevant and effective.

Embracing the Future with Confidence

In summary, IUL is an excellent tool for helping you write your financial story in a way that fits your unique narrative.

Its ability to cut through complexity, combined with its customization options, tax advantages, and flexibility, makes it a powerful and accessible solution for those seeking to simplify their financial planning without sacrificing sophistication.

Ready to simplify your financial world while embracing its potential for complexity and growth? Let’s chat. Our team is eager to help you explore how Index Universal Life Insurance can serve as the cornerstone of a strategy that unifies your financial aspirations, from protecting your loved ones to building a legacy of wealth. Reach out to us at TetonPines Financial, and let’s build that brighter future together.

Build wealth like the wealthy.

Our Wealth Builder account unlocks the knowledge you need to control your assets, gain financial security, and avoid the risks of the stock market.

With a Wealth Builder account, you get:

Guaranteed, predictable growth.

No luck, skill, or guesswork is required.

Secure savings and no crashes.

Tax advantages in the thousands.

On-demand liquidity.

Fees that don’t compound against you.

The ability to leave a hassle-free legacy.

The pay-off on your Wealth Builder account is likely to be many times larger than the total amount you’ve paid into it. This passes to your loved ones and/or your favorite charities, income tax-free and without going through probate. If you die prematurely, your account can still finish funding itself, which won’t happen with traditional retirement plans.

Choose TetonPines Financial to Get Started Today!

At TetonPines Financial, we’re passionate about helping you explore the multifunctional benefits of IUL. We believe in strategies that simplify the complexities of financial planning and unlock possibilities for our clients. IUL is more than insurance; it’s a strategic, adaptable solution designed for individuals who seek to maximize their financial potential while maintaining the flexibility to navigate life’s twists and turns.

Ready to explore how IUL can serve as your financial Swiss Army knife? Reach out to us. Let’s discuss how this versatile tool can enhance your financial strategy, helping you build a secure, prosperous future that aligns with your dreams and aspirations. With IUL, you’re not just planning for tomorrow; you’re equipped for whatever comes your way, confident that your financial foundation is solid, adaptable, and ready for the future.

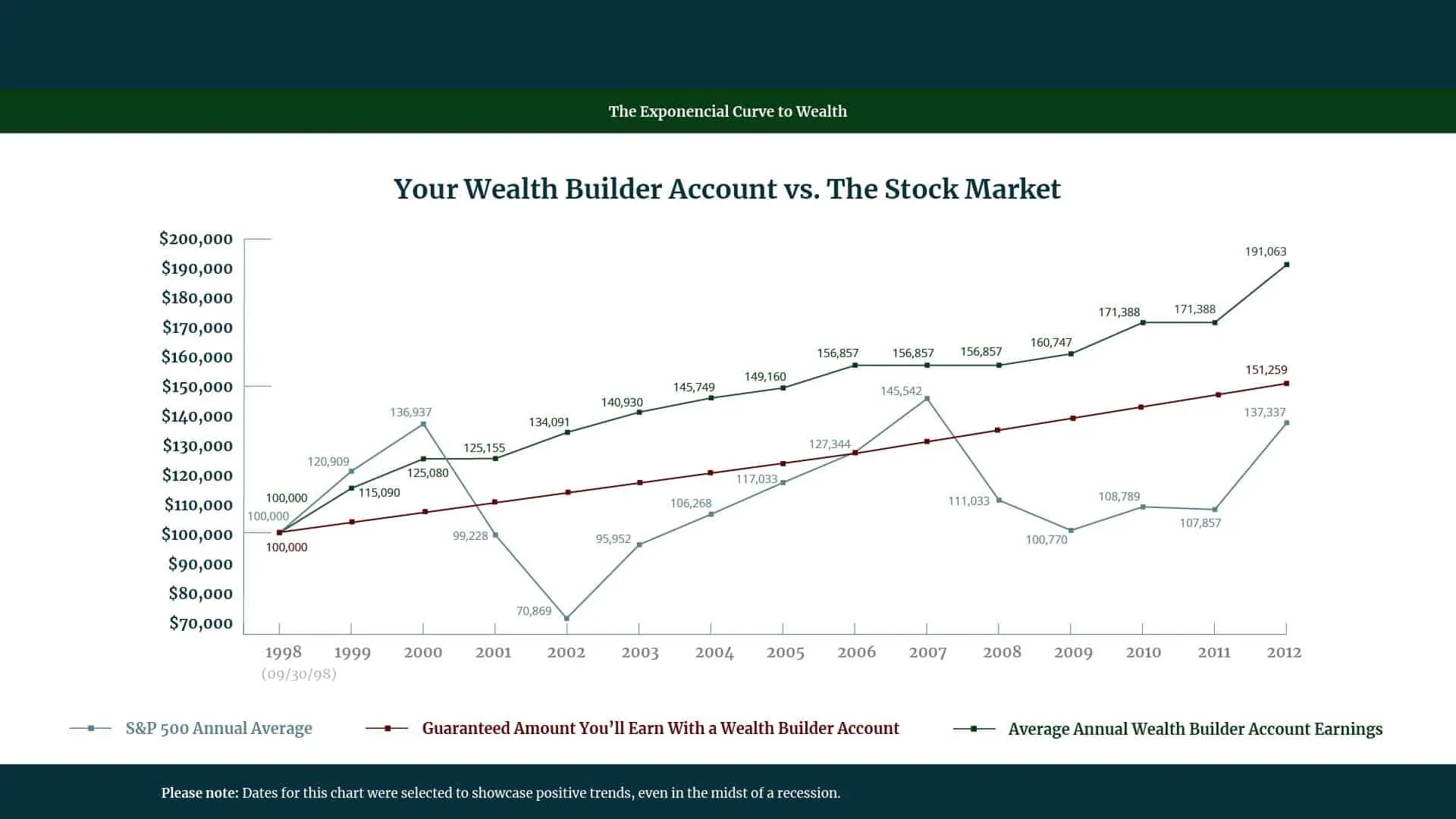

How does a Wealth Builder Account compare to the stock market?

A plan

you can count on

Schedule

a call

During a complimentary, no-pressure chat, we’ll get a financial snapshot of where you stand now and where you want to be in the future.

Get

honest guidance

Next, we’ll do a deep dive into your financial portfolio and complete a free cash flow analysis that will help me recommend a plan that eliminates your debt and builds your wealth.

Reach

your goals

With the right plan, expert guidance, and user-friendly tools, you’ll be fully equipped to take control of your finances and build a legacy for those you love.